how much of my paycheck goes to taxes in colorado

If your teen was an employee which means they filled out a W-4 form for their employer when they started their job and had withholding taxes taken from their paycheck they may need to file a. Break the paycheck-to-paycheck cycle by aiming to reach the point of using the money you earned last month to pay this months expenses.

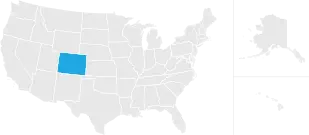

Colorado Paycheck Calculator Smartasset

About a year ago my dad was diagnosed with lung cancer and 2 days ago he had a stroke and is currently in the ICU.

. My mother is losing her mental health trying to keep everything together. To do so there are multiple levels of taxation that you need to dive into and analyze. Its gunite and goes from 35-75 ft with a built-in hot tub.

I started budgeting in my midlate 20s and couldnt believe how much money I. February 17 2022 at 1116 am. Once you conclude that you satisfy the criteria it is time to see just how much taxes will you pay on 1099 income.

She works full time to pay for my dads medical bills and is sitting in the hospital now with the 4 kids because my brother is still passed out in the house. Taxes Imposed on Independent Contractors. Federal Income Tax.

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Paycheck Calculator Take Home Pay Calculator

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Paycheck Calculator Take Home Pay Calculator

Payroll Tax What It Is How To Calculate It Bench Accounting

New Tax Law Take Home Pay Calculator For 75 000 Salary

Free Online Paycheck Calculator Calculate Take Home Pay 2022

What Percentage Of Taxes Are Taken Out Of Paycheck In Nova Scotia Cubetoronto Com